More isn’t better: the case for change.

Too often in B2B we see companies falling back on familiar and “safe” strategies that not only create friction with potential customers, but also wastefulness with limited marketing investment.

Whether it’s restricting the circulation of awareness content through gated downloads (bad), advertising blindly without regard to buyer groups and buying cycles (worse) or filling the funnel with ‘leads’ that might match ICP criteria but don’t have a purchasing need (worst), we should all be able to agree that the rinse-and-repeat tactics of the past decade are having a diminished impact on the bottom line.

And while the old playbook might result in short term gains that look good in QBRs, and possibly even unlock year-end bonuses, it’s often at the expense of long-term organizational step change.

So, what do we need to do differently? For starters, build a strong and differentiated brand that creates familiarity and, ideally, preference long before a buying need emerges. We need to get on the “day 1 list”, which ironically, is conceived long before they begin their research journey. And we need to focus the company’s resource-intensive demand gen activities on the right people, in the right accounts, at the right time—and with the right intelligence to inform your message.

How did we get here?

Part of the problem is that for far too long companies have adhered to reward schemes built on commodities—and they still do, to this day. Things like impressions or leads, which can be purchased instead of earned (often at bargain prices), and which mask real impact on pipeline. We call them vanity metrics because they create the optical illusion of success.

The reason marketers do this is because they’re fighting for their jobs. Fighting for that last click/last touch attribution, since their organizations are not thinking of success as a shared objective– but rather, one where growth needs to be sourced and credited.

According to Forrester, a volume-based lead gen strategy will see less than 1% of MQLs turn to close won deals. In other words, 99% of leads generated are going straight to the recycling bin. This is not just alarming—it’s reckless. It’s the business equivalent to lighting cash on fire.

The other problem is widely known and discussed ad nauseum: silos and the lack of alignment between sales and marketing. However, this is a symptom of a poorly designed incentive system that promotes insularity between departments and results in a fragmented view of the customer.

If we want greater transparency, collaboration, and shared accountability across the enterprise, we need to move away from channel-specific vanity metrics and towards customer metrics that are shared across marketing and sales, and that more accurately represent the growth potential.

A new approach: the Not-so-B2B Growth Engine

Our approach is a deliberate attempt to move away from the traditional B2B acquisition model which goes something like this: marketing buys a lot of leads to hit their MQL target, but they don’t convert because these ‘leads’ don’t need what you’re selling (or maybe they don’t need it right now). This creates bad sentiment, both with customers who feel spammed and ushered into a conversation they’re not ready for, and internally with sales who are forced to work bad—sometimes impossible – leads. All of this fuels the perception that marketing hasn’t done their job.

Instead, our not-so-B2B model is built around a simple and often overlooked truth: that at any given time, only 5% of your target audience is in-market. This is because of the long and cyclical buying patterns in enterprise tech. So instead of trying to acquire leads at all costs, we should focus on converting the 5% subset that exhibits the highest propensity to buy, and prime the 95% (i.e., your future potential customers) by building brand awareness and familiarity early on.

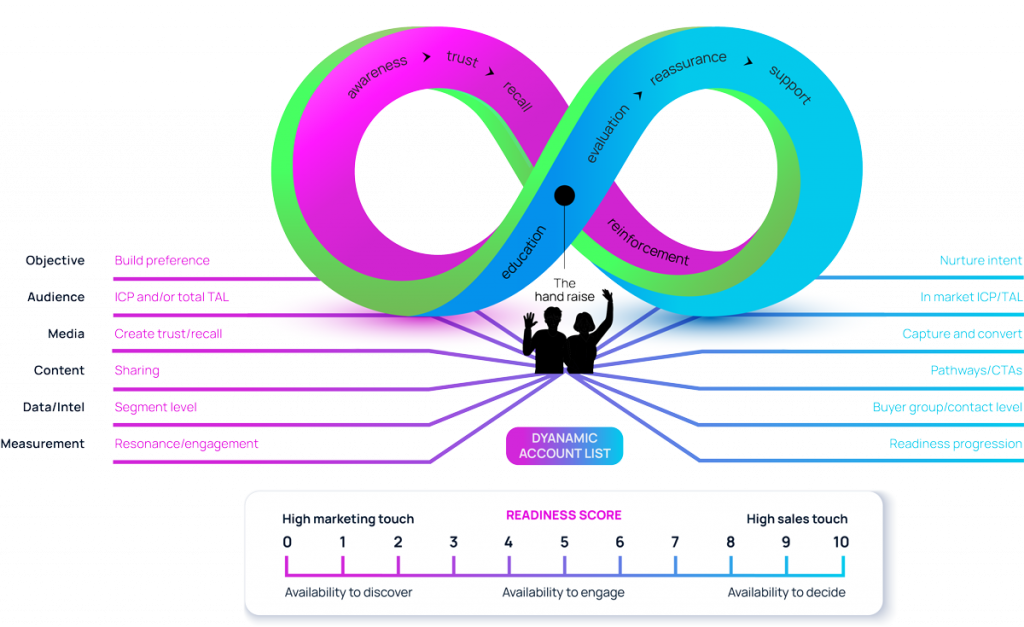

Revving the engine with dynamic account lists.

The not-so-B2B growth engine, at its core, is fueled by dynamic account lists. This is essential and cannot be overstated.

The reason is simple: customers and accounts are fluid. They might not have a need today, but they could tomorrow. Some members of the buying group might have started searching for your services, but not everyone. The use of dynamic lists allows us to closely monitor the changes in behavior that are observed within an account, in real time, so that we’re not late to the party.

But it’s not so simple. If we’re not careful, we’ll be swimming in a sea of data, and this can cause analysis paralysis. Every brand needs to ask themselves three important questions:

- What behaviors do we care about?

- When do those behaviors signify buyer signals?

- How do we separate those buyer signals from all the noise?

This is the backbone of setting up your intent data strategy, another fundamental part of the not-so B2B growth engine.

Move over lead scoring, it’s time for readiness scoring.

Typically, we workshop an intent data strategy directly with our clients.

First, we’ll identify the various data (across first, second and third-party sources) that they have visibility into and define the context through which they should be applied and interpreted in campaign activation.

Second, we’ll establish a weighted scoring system to ascertain buyer readiness. This takes the form of an index, custom-built for each client, and enables us to direct their total marketing investment across the in-market (5%) and out-of-market groups (95%) and the supporting motions of brand building, demand generation, sales enablement, and customer engagement.

Third, we’ll monitor the change in readiness within engaged accounts: from the moment a need emerges, to surging interest across the buyer group, through to the research and competitive evaluation stage. Understanding how intent data signals manifest differently earlier vs. later in the journey is crucial, otherwise you risk overlooking them and missing the opportunity to act.

It’s not about brand to demand. It’s about go-to-market.

We believe in strong brands, well-oiled demand machines, and making sure they work together. But what we need right now is not just ‘brand to demand’ – it goes beyond that.

We need to talk about go-to-market: a more intelligent, dynamic, and responsive approach to activating your marketing investment. So that friction with customers is eliminated, waste of scarce internal resources is reduced, and a new model of shared accountability finally emerges.

Want to know more? Get in touch.